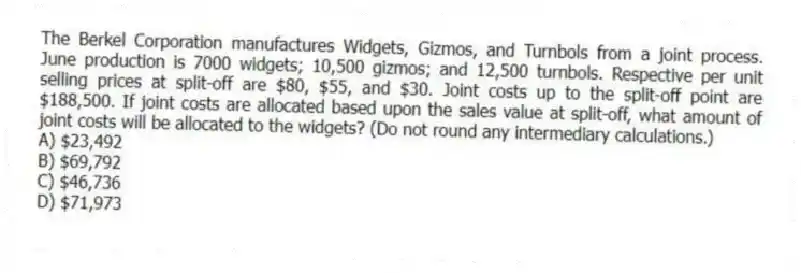

The Berkel Corporation manufactures Widgets, Gizmos, and Turnbols from a joint process. June production is 7000 widgets; 10,500 gizmos; and 12,500 turnbols. Respective per unit selling prices at split-off are $80, $55, and $30. Joint costs up to the split-off point are $188,500. If joint costs are allocated based upon the sales value at split-off, what amount of joint costs will be allocated to the widgets? (Do not round any intermediary calculations.)

A) $23,492

B) $69,792

C) $46,736

D) $71,973

Correct Answer:

Verified

Q40: List three reasons why we allocate joint

Q41: Bismite Corporation purchases trees from Cheney lumber

Q42: Netzone Company is in semiconductor industry and

Q43: How does the physical-measure method allocate joint

Q44: The Alfarm Corporation processes raw milk up

Q46: Which of the following formulas would calculate

Q47: Bismite Corporation purchases trees from Cheney lumber

Q48: The Berkel Corporation manufactures Widgets, Gizmos, and

Q49: Bismite Corporation purchases trees from Cheney lumber

Q50: Bismite Corporation purchases trees from Cheney lumber

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents