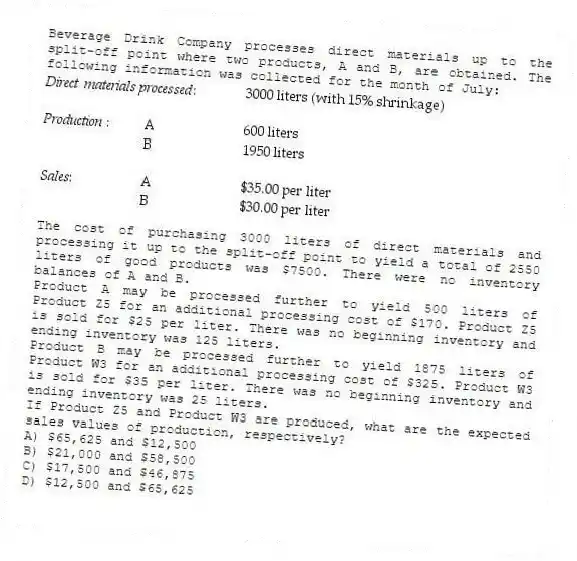

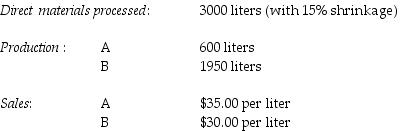

Beverage Drink Company processes direct materials up to the split-off point where two products, A and B, are obtained. The following information was collected for the month of July:

The cost of purchasing 3000 liters of direct materials and processing it up to the split-off point to yield a total of 2550 liters of good products was $7500. There were no inventory balances of A and B.

Product A may be processed further to yield 500 liters of Product Z5 for an additional processing cost of $170. Product Z5 is sold for $25 per liter. There was no beginning inventory and ending inventory was 125 liters.

Product B may be processed further to yield 1875 liters of Product W3 for an additional processing cost of $325. Product W3 is sold for $35 per liter. There was no beginning inventory and ending inventory was 25 liters.

If Product Z5 and Product W3 are produced, what are the expected sales values of production, respectively?

A) $65,625 and $12,500

B) $21,000 and $58,500

C) $17,500 and $46,875

D) $12,500 and $65,625

Correct Answer:

Verified

Q58: Which of the following reasons explain why

Q59: Netzone Company is in semiconductor industry and

Q60: Bismite Corporation purchases trees from Cheney lumber

Q61: The Green Company processes unprocessed goat milk

Q62: The Kenton Company processes unprocessed milk to

Q64: Which of the following is true of

Q65: The Kenton Company processes unprocessed milk to

Q66: The Brital Company processes unprocessed milk to

Q67: The Green Company processes unprocessed goat milk

Q68: The Kenton Company processes unprocessed milk to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents