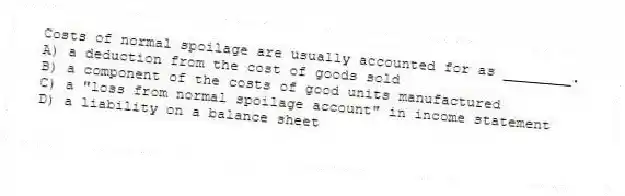

Costs of normal spoilage are usually accounted for as ________.

A) a deduction from the cost of goods sold

B) a component of the costs of good units manufactured

C) a "loss from normal spoilage account" in income statement

D) a liability on a balance sheet

Correct Answer:

Verified

Q4: Spoilage that is not inherent in a

Q5: Which of the following describes rework?

A) units

Q6: The loss from abnormal spoilage account would

Q7: For each of the following items identify

Q8: Some amounts of spoilage, rework, or scrap

Q10: Which of the following defines spoilage?

A) units

Q11: Distinguish among spoilage, reworked units, and scrap.

Q12: Rework is residual material that results from

Q13: A leather shoe manufacturer makes "duck" boots

Q14: Spoilage that is an inherent result of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents