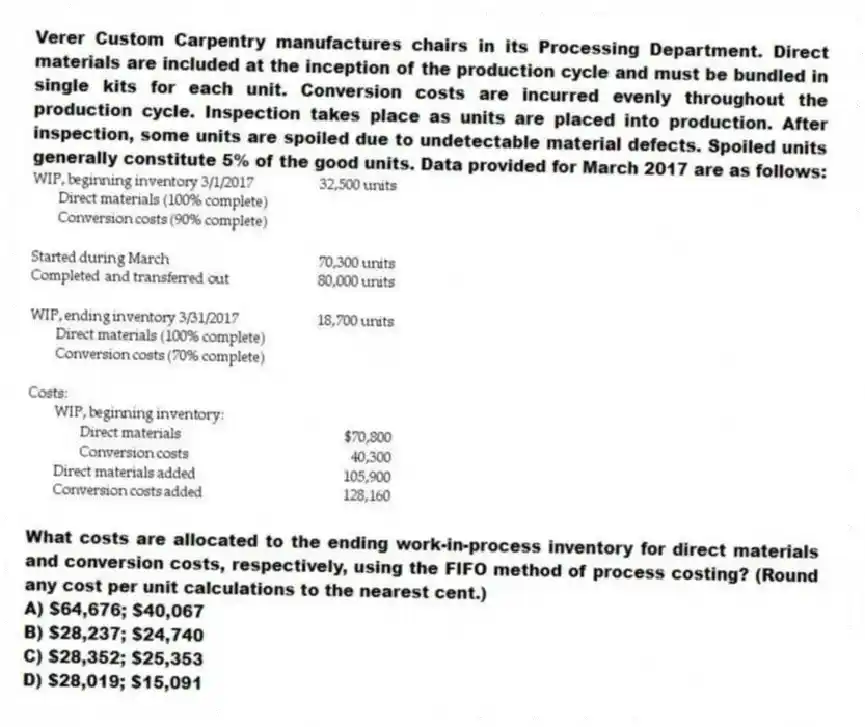

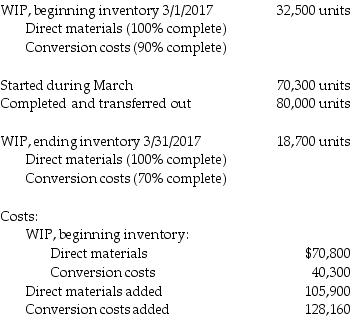

Verer Custom Carpentry manufactures chairs in its Processing Department. Direct materials are included at the inception of the production cycle and must be bundled in single kits for each unit. Conversion costs are incurred evenly throughout the production cycle. Inspection takes place as units are placed into production. After inspection, some units are spoiled due to undetectable material defects. Spoiled units generally constitute 5% of the good units. Data provided for March 2017 are as follows:

What costs are allocated to the ending work-in-process inventory for direct materials and conversion costs, respectively, using the FIFO method of process costing? (Round any cost per unit calculations to the nearest cent.)

A) $64,676; $40,067

B) $28,237; $24,740

C) $28,352; $25,353

D) $28,019; $15,091

Correct Answer:

Verified

Q71: Based on the following information from a

Q72: Verer Custom Carpentry manufactures chairs in its

Q73: Samantha's Office Supplies manufactures desk organizers in

Q74: Under the weighted-average method, the costs of

Q75: Samantha's Office Supplies manufactures desk organizers in

Q77: Under the FIFO method, all spoilage costs

Q78: Samantha's Office Supplies manufactures desk organizers in

Q79: Spoilage and rework costs are thoroughly captured

Q80: Costs in beginning inventory are pooled with

Q81: Early inspections can _.

A) prevent any further

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents