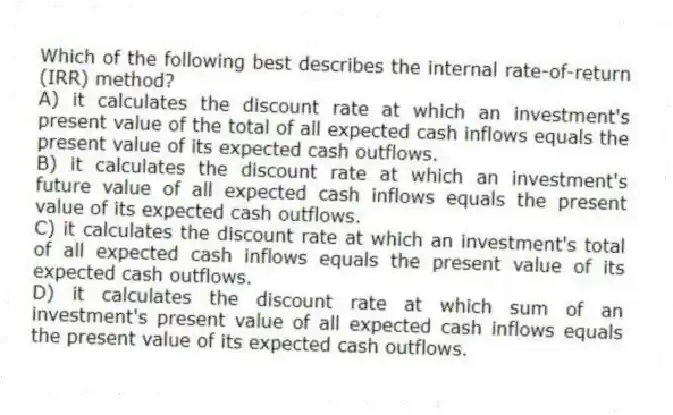

Which of the following best describes the internal rate-of-return (IRR) method?

A) it calculates the discount rate at which an investment's present value of the total of all expected cash inflows equals the present value of its expected cash outflows.

B) it calculates the discount rate at which an investment's future value of all expected cash inflows equals the present value of its expected cash outflows.

C) it calculates the discount rate at which an investment's total of all expected cash inflows equals the present value of its expected cash outflows.

D) it calculates the discount rate at which sum of an investment's present value of all expected cash inflows equals the present value of its expected cash outflows.

Correct Answer:

Verified

Q42: A general rule in capital budgeting is

Q43: Which of the following best explains why

Q44: A "what-if" technique that examines how a

Q45: In situations where the required rate of

Q46: Diamond Manufacturing Company provides glassware machines for

Q48: Midize Flower Company provides flowers and other

Q49: Which of the following is an advantage

Q50: The Comil Corporation recently purchased a new

Q51: Investment A requires a net investment of

Q52: The capital budgeting method that calculates the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents