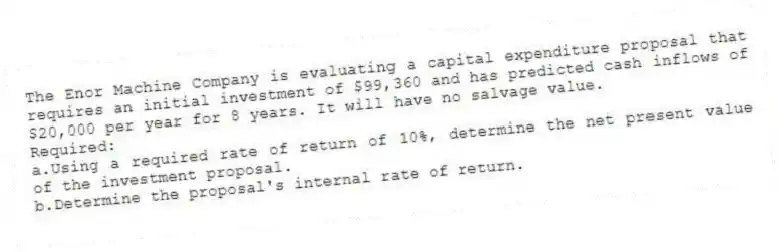

The Enor Machine Company is evaluating a capital expenditure proposal that requires an initial investment of $99,360 and has predicted cash inflows of $20,000 per year for 8 years. It will have no salvage value.

Required:

a.Using a required rate of return of 10%, determine the net present value of the investment proposal.

b.Determine the proposal's internal rate of return.

Correct Answer:

Verified

b.Present value factor o...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: The payback method of capital budgeting approach

Q72: Discounted cash flow methods of evaluating capital

Q73: The net present value method can be

Q74: The net present value method accurately assumes

Q75: Flilane Tire Company needs to overhaul its

Q77: EIF Manufacturing Company needs to overhaul its

Q78: Network Service Center is considering purchasing a

Q79: The Required Rate of Return (RRR) is

Q80: Which of the following methods of capital

Q81: The AARR method is similar to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents