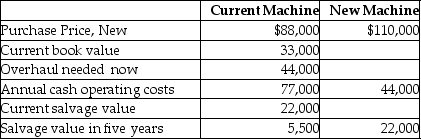

EIF Manufacturing Company needs to overhaul its drill press or buy a new one. The facts have been gathered, and they are as follows:

Required:

Which alternative is the most desirable with a current required rate of return of 20%? Show computations, and assume no taxes.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Discounted cash flow methods of evaluating capital

Q73: The net present value method can be

Q74: The net present value method accurately assumes

Q75: Flilane Tire Company needs to overhaul its

Q76: The Enor Machine Company is evaluating a

Q78: Network Service Center is considering purchasing a

Q79: The Required Rate of Return (RRR) is

Q80: Which of the following methods of capital

Q81: The AARR method is similar to the

Q82: If there are non-uniform cash flows (cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents