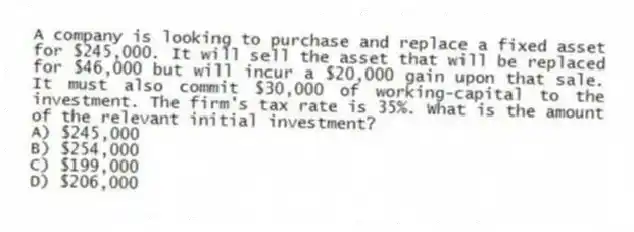

A company is looking to purchase and replace a fixed asset for $245,000. It will sell the asset that will be replaced for $46,000 but will incur a $20,000 gain upon that sale. It must also commit $30,000 of working-capital to the investment. The firm's tax rate is 35%. What is the amount of the relevant initial investment?

A) $245,000

B) $254,000

C) $199,000

D) $206,000

Correct Answer:

Verified

Q98: Sam's Structures desires to buy a new

Q99: Accrual accounting rate of return is calculated

Q100: Unlike the payback method, which ignores cash

Q101: The Venoid Corporation has an annual cash

Q102: The accrual accounting rate-of-return method has a

Q104: The Ambitz Corporation has an annual cash

Q105: As cash flows and time value of

Q106: Which of the following is a component

Q107: The focus in capital budgeting should be

Q108: The galaxy Corporation disposes a capital asset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents