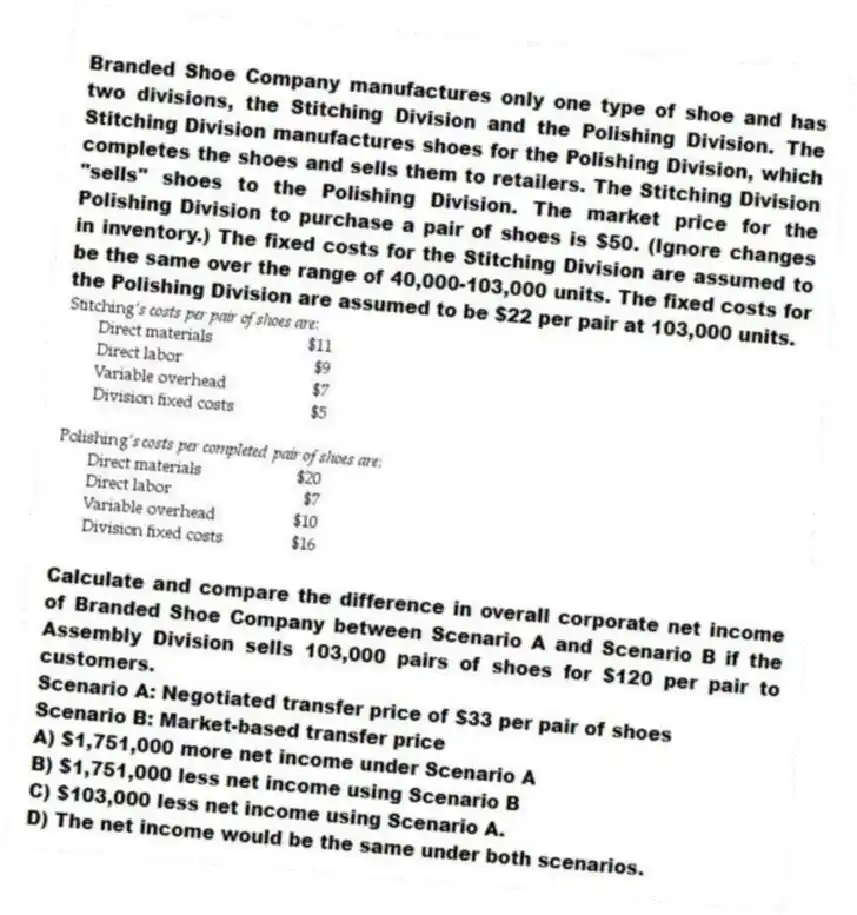

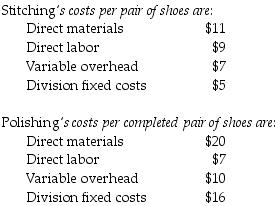

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $50. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-103,000 units. The fixed costs for the Polishing Division are assumed to be $22 per pair at 103,000 units.

Calculate and compare the difference in overall corporate net income of Branded Shoe Company between Scenario A and Scenario B if the Assembly Division sells 103,000 pairs of shoes for $120 per pair to customers.

Scenario A: Negotiated transfer price of $33 per pair of shoes

Scenario B: Market-based transfer price

A) $1,751,000 more net income under Scenario A

B) $1,751,000 less net income using Scenario B

C) $103,000 less net income using Scenario A.

D) The net income would be the same under both scenarios.

Correct Answer:

Verified

Q74: Branded Shoe Company manufactures only one type

Q75: Hybrid transfer prices can be arrived at

Q76: Plish Company manufactures only one type of

Q77: Plish Company manufactures only one type of

Q78: The choice of a transfer-pricing method has

Q80: Plish Company manufactures only one type of

Q81: What are distress prices and which transfer

Q82: The River Falls Company has two divisions.

Q83: Aerated Water Company makes internal transfers at

Q84: For each of the following, identify whether

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents