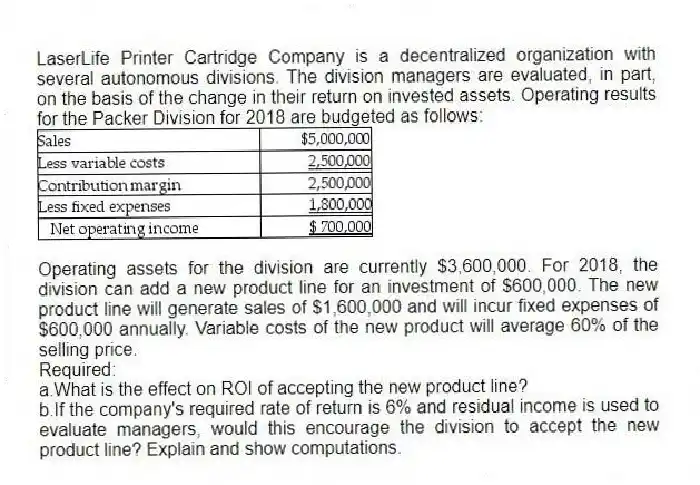

LaserLife Printer Cartridge Company is a decentralized organization with several autonomous divisions. The division managers are evaluated, in part, on the basis of the change in their return on invested assets. Operating results for the Packer Division for 2018 are budgeted as follows:

Operating assets for the division are currently $3,600,000. For 2018, the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60% of the selling price.

Required:

a.What is the effect on ROI of accepting the new product line?

b.If the company's required rate of return is 6% and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

Correct Answer:

Verified

Current ROI = $700,000/$3,600,000 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Stock options give executives the right to

Q127: Capital Investments has three divisions. Each division's

Q128: Which of the following describes boundary control

Q129: Many manufacturing, marketing, and design problems require

Q130: An important consideration in designing compensation arrangements

Q132: Which of the following is true of

Q133: Which of the following is a difference

Q134: There should be strict congruence between the

Q135: Craylon Corp. is planning the 2018 operating

Q136: Which of the following is true of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents