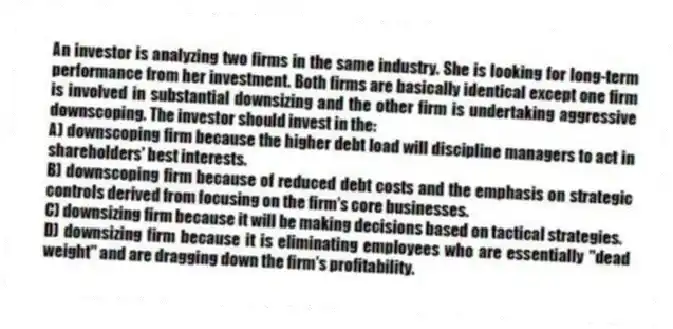

An investor is analyzing two firms in the same industry. She is looking for long-term performance from her investment. Both firms are basically identical except one firm is involved in substantial downsizing and the other firm is undertaking aggressive downscoping. The investor should invest in the:

A) downscoping firm because the higher debt load will discipline managers to act in shareholders' best interests.

B) downscoping firm because of reduced debt costs and the emphasis on strategic controls derived from focusing on the firm's core businesses.

C) downsizing firm because it will be making decisions based on tactical strategies.

D) downsizing firm because it is eliminating employees who are essentially "dead weight" and are dragging down the firm's profitability.

Correct Answer:

Verified

Q90: Which of the following is NOT a

Q103: A leveraged buyout refers to:

A) a firm

Q104: Whole-firm LBOs tend to result in all

Q105: Typically, in a failed acquisition, the organization

Q106: The term "leverage" in leveraged buyouts refers

Q107: Which of the following is NOT an

Q111: _ refers to a divestiture, spin-off, or

Q112: _ is often used when the acquiring

Q113: _ may be necessary because acquisitions create

Q120: Which of the following is NOT one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents