Use the following information to answer the next fifteen questions.

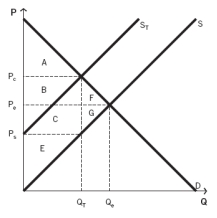

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-When a tax is imposed on some good,what tends to happen to consumer prices and producer prices?

A) Consumer prices decrease and producer prices increase.

B) Consumer prices increase and producer prices decrease.

C) consumer prices increase and producer prices increase.

D) Consumer prices decrease and producer prices increase .

E) Consumer prices And producer prices converge at the same point.

Correct Answer:

Verified

Q49: Use the following information to answer the

Q54: Use the following information to answer the

Q55: Use the following information to answer the

Q60: Use the following information to answer the

Q64: A tax that is applied to one

Q65: If a tax causes the supply curve

Q67: After a tax is imposed,the price paid

Q72: A tax on apples would cause the

Q83: For any type of tax the government

Q90: In the long run,both supply and demand

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents