THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

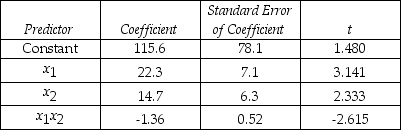

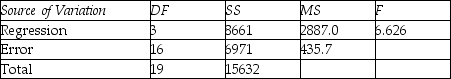

An economist is in the process of developing a model to predict the price of gold.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the model y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below.

THE REGRESSION EQUATION IS

y = 115.6 + 22.3x1 + 14.7x2 - 1.36x1x2

S = 20.9 R-Sq = 55.4%

ANALYSIS OF VARIANCE

-Suppose that a regression relationship is given by Y = β0 + β1X1 + β2X2 + ε.If the simple linear regression of Y on X1 is estimated from a sample of n observations,the resulting slope estimate will generally be biased for β1.But if the sample correlation between X1 and X2 is 0,the slope will not be biased for β1.

How does X2 affect β1 if the sample correlation between X1 and X2 is zero?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q150: Test the hypotheses H0: There is no

Q151: THE NEXT QUESTIONS ARE BASED ON THE

Q152: THE NEXT QUESTIONS ARE BASED ON THE

Q154: THE NEXT QUESTIONS ARE BASED ON THE

Q155: THE NEXT QUESTIONS ARE BASED ON THE

Q157: THE NEXT QUESTIONS ARE BASED ON THE

Q158: THE NEXT QUESTIONS ARE BASED ON THE

Q159: THE NEXT QUESTIONS ARE BASED ON THE

Q160: THE NEXT QUESTIONS ARE BASED ON THE

Q161: THE NEXT QUESTIONS ARE BASED ON THE

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents