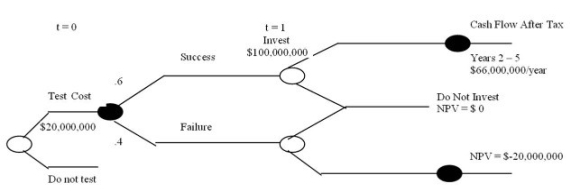

The project defined by the following decision tree has a required discount rate of 14 percent.  What is the Time 1 net present value of a successful investment?

What is the Time 1 net present value of a successful investment?

A) $89,406,415

B) $92,305,012

C) $87,342,087

D) $122,008,054

E) $126,583,344

Correct Answer:

Verified

Q52: The estimates for a project include a

Q53: Ernestine is analyzing a 4-year project with

Q54: A 6-year project has expected sales of

Q55: A project has earnings before interest and

Q56: The Meat Mart has computed its fixed

Q58: At a production level of 5,150 units,a

Q59: The Garden Mart is analyzing a proposed

Q60: DK Markets expects a new project to

Q61: Mosler Company is considering a project requiring

Q62: A project has a contribution margin of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents