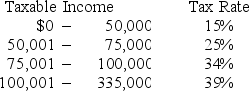

Given the tax rates as shown,what is the average tax rate for a firm with taxable income of $228,610?

A) 36.38%

B) 33.88%

C) 31.67%

D) 34.64%

E) 39.00%

Correct Answer:

Verified

Q39: Your _ tax rate is the percentage

Q40: _ refers to a firm's interest payments

Q41: Lester's has $33,600 in sales,$17,200 in cost

Q42: Martha's Enterprises spent $3,300 to purchase equipment

Q43: The Down Towner has annual costs of

Q45: Assume sales are $1,100,cost of goods sold

Q46: MLM Enterprises has net income of $984,interest

Q47: Assume sales are $2,220;cost of goods sold

Q48: The cash flow from operating activities decreases

Q49: A change in which one of these

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents