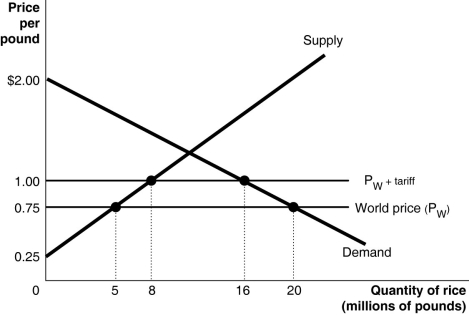

Figure 19-8

-Refer to Figure 19-8.Suppose the U.S.government imposes a $0.25 per pound tariff on rice imports.Figure 19-8 shows the demand and supply curves for rice and the impact of this tariff.Use the figure to answer questions a-i.

a.Following the imposition of the tariff,what is the price that domestic consumers must now pay and what is the quantity purchased?

b.Calculate the value of consumer surplus with the tariff in place.

c.What is the quantity supplied by domestic rice growers with the tariff in place?

d.Calculate the value of producer surplus received by U.S.rice growers with the tariff in place.

e.What is the quantity of rice imported with the tariff in place?

f.What is the amount of tariff revenue collected by the government?

g.The tariff has reduced consumer surplus.Calculate the loss in consumer surplus due to the tariff.

h.What portion of the consumer surplus loss is redistributed to domestic producers? To the government?

i.Calculate the deadweight loss due to the tariff.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: A quota is a numerical limit on

Q148: Distinguish between a voluntary export restraint and

Q163: a.Distinguish between a tariff and a quota.

b.In

Q168: Free trade _ living standards by _

Q172: _ raised average tariff rates by over

Q174: Disagreements about whether the U.S.government should regulate

Q175: Imposing trade barriers does all of the

Q178: Protectionism

A)is the use of cheap labor to

Q179: In 1995 _, which was established in

Q308: Figure 19-9

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents