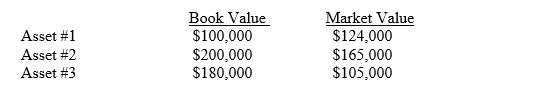

Julia Corp has three asset whose market values differ from their book values.

The market value of the first asset is expected to remain above the book value of Asset #1

The market value of the first asset is expected to remain above the book value of Asset #1

for the life of the asset.

The market value of the second asset moves above and below the book value from year to

year.

The market value of the last asset is viewed as a permanent decline below the book value

of the asset.

Required:

A.Make the entry(ies) necessary to record the differences between the market and book values of the assets.

B.If the book values are adjusted to market values what impact will this have on the depreciation of the adjusted asset?

Correct Answer:

Verified

Q79: Why might the returns on assets of

Q80: Ivy,Incorporated,purchased all the common stock of Harrell

Q81: Match the following financial statement classifications with

Q82: Match the following classifications with the accounts

Q83: Match the following terms with the descriptions

Q84: Healy Fabrication Corp wants to trade in

Q85: Match the following with the definitions and

Q87: Jackson Corporation has a forklift that it

Q88: Calculate the depreciation for a $246,000 asset

Q89: Gfeller Corporation had a machine,which initially cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents