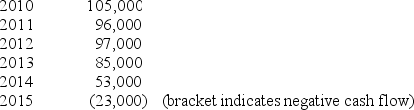

The Psychic Cookie Company is considering the purchase of a new machine to produce fortune cookies in January 2010.The fortune cookie machine will cost $270,000 and Psychic's management expects it to last 6 years.If it purchases the new machine it will sell its old machine with a book value of $20,000 for $25,000 cash.At the end of six years the new machine is expected to have no salvage value.Depreciation each year on the fortune cookie machine will be $45,000 and Psychic's tax rate is 30%.The Pretax cash flows expected from the machine at the end of the following year are:

Required:

Required:

(A.)Calculate the net present of the new machine if the cost of capital is 15%.

(B.)Indicate whether or not Psychic should buy the new machine and explain the basis for your decision (do not use positive or negative NPV as an explanation):

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: After arriving at a positive net present

Q59: A method for assessing how changes in

Q60: Spivey Corp just conducted a NPV analysis

Q61: Match the following terms with the definitions

Q62: Depreciation expense taken on plant assets does

Q64: Mendocino Company is contemplating the acquisition of

Q65: Why should qualitative factors be considered in

Q66: Standard Corporation is considering the purchase of

Q67: After computing a net present value that

Q68: What constitutes sensitivity analysis when using net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents