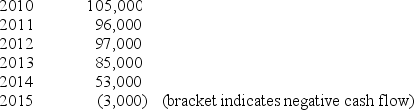

The Katrina Corp is considering the purchase of a new machine that produces hurricane proof windows in January 2010.The window machine will cost $300,000 and Katrina's management expects it to last 6 years.At the end of six years the new machine is expected to have a zero book value but could be sold for $25,000.Depreciation each year on the window machine will be $50,000 and Katrina's tax rate is 30%.The Pretax cash flows expected from the machine are as follows:

Required:

Required:

(A.)Calculate the net present of the new machine if the cost of capital is 15%.

(B.)Indicate whether or not Katrina should buy the new machine and explain the basis for your decision (do not use positive or negative NPV as an explanation):

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: What constitutes sensitivity analysis when using net

Q69: Explain why both the timing and quantity

Q70: Barton Inc had assets of $15,350,000 and

Q71: At the end of 2010,Bezdek Corporation is

Q72: Late in 2010,the Spencer K Corporation has

Q73: Weimer Systems,Inc.is considering the purchase of a

Q74: Gfeller Brothers had earnings before interest of

Q76: Champion Contractors had earnings before interest of

Q77: Huntel Systems,Inc.is considering the purchase of a

Q78: Explain how performance evaluation based on accrual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents