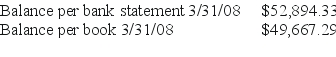

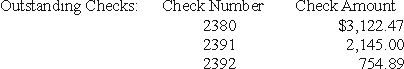

The Ogallah Corporation wants its bank reconciliation for March 2008 prepared and has gathered the following information.

Bank Service Charge for March 2008 $46

Bank Service Charge for March 2008 $46

Ogallah wrote check number 2347 for $679.23 but the check was recorded as $769.23 on Ogallah's books.

The bank statement contained a NSF check that totaled $566 and the $35 charge to process the NSF check.

Interest earned on checking account during March 2008 $216.39.

Deposits in Transit $2,567.23.

Required: Using a two-column bank reconciliation,determine the dollar amount of the error the bank made in March 2008.Assume that all adjustments to the cash per book are correct and complete.

Correct Answer:

Verified

Students must first determin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: Which of the following will required the

Q76: Billing customers is part of which of

Q77: For each of the items below,explain how

Q78: Which of the following bank reconciliation items

Q79: On a bank reconciliation,which of the following

Q80: Which of the following is not a

Q81: Match the following terms with the definitions

Q83: Match the following terms with the definitions

Q84: Using the financial statements below calculate each

Q85: From the information below create a two-column

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents