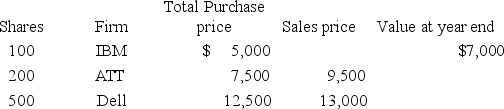

This year Ann has the following stock transactions.What amount is included in her gross income if Ann paid a $200 selling commission for each sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: This year Zach was injured in an

Q107: Aubrey and Justin divorced on June 30

Q111: Kathryn is employed by Acme and they

Q112: Terri and Mike are seeking a divorce.Terri

Q116: Pam recently was sickened by eating spoiled

Q125: Juan works as a landscaper for local

Q129: Charles purchased an annuity from an insurance

Q130: Henry works part time on auto repairs

Q152: Cyrus is a cash method taxpayer who

Q172: Wendell is an executive with CFO Tires.At

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents