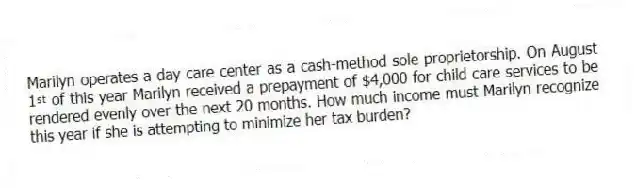

Marilyn operates a day care center as a cash-method sole proprietorship. On August 1ˢᵗ of this year Marilyn received a prepayment of $4,000 for child care services to be rendered evenly over the next 20 months. How much income must Marilyn recognize this year if she is attempting to minimize her tax burden?

Correct Answer:

Verified

Prepayments a...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Anne is a self-employed electrician who reports

Q85: Sandy Bottoms Corporation generated taxable income (before

Q89: David purchased a deli shop on February

Q90: Mike operates a fishing outfitter as an

Q91: Bob operates a clothing business using the

Q100: Danny owns an electronics outlet in Dallas.

Q102: Gabby operates a pizza delivery service. This

Q105: Otto operates a bakery and is on

Q122: Shadow Services uses the accrual method and

Q129: Colby Motors uses the accrual method and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents