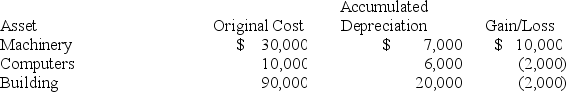

Brandon,an individual,began business four years ago and has never sold a §1231 asset.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

A) $7,000 ordinary income, $1,000 §1231 loss and $2,100 tax liability.

B) $6,000 ordinary income and $2,100 tax liability.

C) $7,000 §1231 gain and $2,450 tax liability.

D) $7,000 §1231 gain and $1,050 tax liability.

E) None of the choices are correct.

Correct Answer:

Verified

Q62: Each of the following is true except

Q62: Winchester LLC sold the following business assets

Q67: Which of the following is true regarding

Q68: Arlington LLC traded machinery used in its

Q69: Which one of the following is not

Q71: When does unrecaptured §1250 gains apply?

A) When

Q72: Ashburn reported a $105,000 net §1231 gain

Q73: What is the primary purpose of a

Q79: Which of the following is not true

Q84: How long after the initial exchange does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents