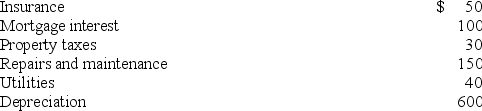

Kristen rented out her home for 10 days during the year for $5,000.She used the home for personal purposes for the other 355 days.She allocated the following home expenses to the rental use of the home:

Kristen's AGI is $120,000 before considering the effect of the rental activity.What is Kristen's AGI after considering the tax effect of the rental use of her home?

Kristen's AGI is $120,000 before considering the effect of the rental activity.What is Kristen's AGI after considering the tax effect of the rental use of her home?

Correct Answer:

Verified

S...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Alfredo is self-employed and he uses a

Q102: Amelia is looking to refinance her home

Q104: Rayleen owns a condominium near Orlando,Florida.This year,she

Q105: Jasper is looking to purchase a new

Q107: Ashton owns a condominium near San Diego,California.This

Q108: Jason and Alicia Johnston purchased a home

Q110: Don owns a condominium near Orlando,California.This year,he

Q111: Joshua and Mary Sullivan purchased a new

Q112: Tyson owns a condominium near Laguna Beach,California.This

Q123: Mercury is self-employed and she uses a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents