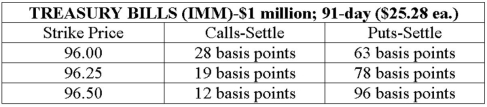

A bank with total assets of $271 million and equity of $31 million has a leverage adjusted duration gap of +0.21 years. Use the following quotation from the Wall Street Journal to construct an at-the-money futures option hedge of the bank's duration gap position.  If 91-day Treasury bill rates increase from 3.75 percent to 4.75 percent, what will be the profit/loss per contract on the bank's futures option hedge?

If 91-day Treasury bill rates increase from 3.75 percent to 4.75 percent, what will be the profit/loss per contract on the bank's futures option hedge?

A) A loss of $556.10 per put option contract.

B) A profit of $556.10 per put option contract.

C) A loss of $1,971.84 per call option contract.

D) A profit of $1,971.84 per call option contract.

E) A profit of $2,528 per put option contract.

Correct Answer:

Verified

Q66: As interest rates increase, the writer of

Q67: Purchasing a succession of call options on

Q70: Using the proceeds from the simultaneous sale

Q73: Which of the following is a good

Q75: The outstanding number of put or call

Q85: What is the advantage of a futures

Q87: Rising interest rates will cause the market

Q90: For put options, the delta has a

Q93: What is the advantage of an options

Q96: Which of the following shows the change

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents