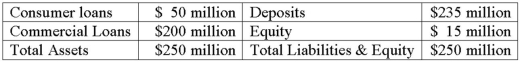

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the change in the value of the FI's equity for a 1 percent increase in interest rates from the current rates of 10 percent ?

What is the change in the value of the FI's equity for a 1 percent increase in interest rates from the current rates of 10 percent ?

A) -$,979,091.

B) -$16,318,182.

C) -$15,979,091.

D) +$16,318,182.

E) +$979,091.

Correct Answer:

Verified

Q92: Use the following two choices to identify

Q93: Use the following two choices to identify

Q94: The uniform guidelines issued by bank regulators

Q95: Conyers Bank holds Treasury bonds with a

Q96: Use the following two choices to identify

Q98: Use the following two choices to identify

Q99: Conyers Bank holds Treasury bonds with a

Q100: Conyers Bank holds Treasury bonds with a

Q101: A U.S. bank issues a 1-year, $1

Q102: A Canadian FI wishes to hedge a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents