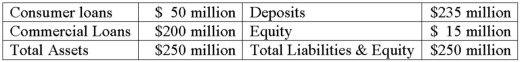

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-Bill futures contracts necessary to hedge the balance sheet if the duration of the deliverable T-bills is 0.25 years and the current price of the futures contract is $98 per $100 face value?

What is the number of T-Bill futures contracts necessary to hedge the balance sheet if the duration of the deliverable T-bills is 0.25 years and the current price of the futures contract is $98 per $100 face value?

A) 6,212 contracts.

B) 6,805 contracts.

C) 6,900 contracts.

D) 7,112 contracts.

E) 7,327 contracts.

Correct Answer:

Verified

Q66: When will the estimated hedge ratio be

Q82: Selling a credit forward agreement generates a

Q82: Use the following two choices to identify

Q83: Conyers Bank holds Treasury bonds with a

Q84: The average duration of the loans is

Q85: Which of the following is NOT true

Q85: Conyers Bank holds Treasury bonds with a

Q86: XYZ Bank lends $20,000,000 to ABC Corporation

Q86: Conyers Bank holds Treasury bonds with a

Q88: Catastrophe futures contracts

A)are designed to protect life

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents