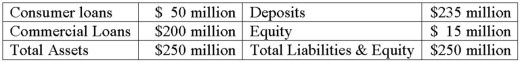

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

A) 1,500 contracts.

B) 1,888 contracts.

C) 2,100 contracts.

D) 2,408 contracts.

E) 3,100 contracts.

Correct Answer:

Verified

Q8: Federal regulations in Canada allow derivatives to

Q15: A spot contract specifies deferred delivery and

Q107: An FI has a 1-year 8-percent US$160

Q108: A U.S. bank issues a 1-year, $1

Q110: An FI has a 1-year 8-percent US$160

Q113: A U.S. bank issues a 1-year, $1

Q114: An FI has a 1-year 8-percent US$160

Q115: A U.S. bank issues a 1-year, $1

Q116: A U.S. bank issues a 1-year, $1

Q117: An FI has a 1-year 8-percent US$160

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents