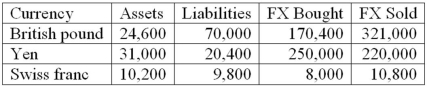

The following are the net currency positions of a Canadian FI (stated in Canadian dollars) .  What is the FI's net exposure in the Swiss franc?

What is the FI's net exposure in the Swiss franc?

A) +2,400.

B) +400.

C) -2,800.

D) -2,400.

E) +3,200.

Correct Answer:

Verified

Q28: Purchasing power parity is based on the

Q43: The decline in European FX volatility during

Q44: The FI is acting as a hedger

Q48: The FI is acting as a speculator

Q49: In which of the following FX trading

Q57: When purchasing and selling foreign currencies to

Q64: If foreign currency exchange rates are highly

Q69: According to purchasing power parity (PPP), foreign

Q73: Most profits or losses on foreign trading

Q74: Which of the following is an example

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents