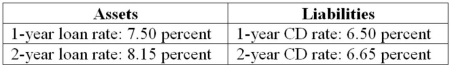

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.  Use the duration model to approximate the change in the market value (per $100 face value) of two-year loans if interest rates increase by 100 basis points.

Use the duration model to approximate the change in the market value (per $100 face value) of two-year loans if interest rates increase by 100 basis points.

A) -$1.756

B) -$1.775

C) +$98.24

D) -$1.000

E) +$1.924

Correct Answer:

Verified

Q87: The following information is about current spot

Q88: Based on an 18-month, 8 percent (semiannual)

Q89: The following information is about current spot

Q90: Consider a five-year, 8 percent annual coupon

Q91: Consider a five-year, 8 percent annual coupon

Q93: Based on an 18-month, 8 percent (semiannual)

Q94: First Duration Bank has the following assets

Q95: The following information is about current spot

Q96: Third Duration Investments has the following assets

Q97: Third Duration Investments has the following assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents