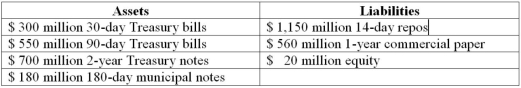

Third Duration Investments has the following assets and liabilities on its balance sheet. The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year.  What is the leverage-adjusted duration gap?

What is the leverage-adjusted duration gap?

A) 0.605 years.

B) 0.956 years.

C) 0.360 years.

D) 0.436 years.

E) 0.189 years.

Correct Answer:

Verified

Q80: Consider a one-year maturity, $100,000 face value

Q81: The numbers provided by Fourth Bank of

Q82: First Duration Bank has the following assets

Q83: The numbers provided by Fourth Bank of

Q84: Consider a six-year maturity, $100,000 face value

Q86: The following information is about current spot

Q87: The following information is about current spot

Q88: Based on an 18-month, 8 percent (semiannual)

Q89: The following information is about current spot

Q90: Consider a five-year, 8 percent annual coupon

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents