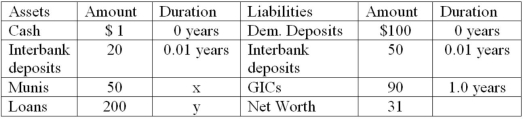

The following is an FI's balance sheet ($millions) .  Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What is this bank's interest rate risk exposure, if any?

A) The bank is exposed to decreasing interest rates because it has a negative duration gap of -0.21 years.

B) The bank is exposed to increasing interest rates because it has a negative duration gap of -0.21 years.

C) The bank is exposed to increasing interest rates because it has a positive duration gap of +0.21 years.

D) The bank is exposed to decreasing interest rates because it has a positive duration gap of +0.21 years.

E) The bank is not exposed to interest rate changes since it is running a matched book.

Correct Answer:

Verified

Q106: The numbers provided are in millions of

Q108: The numbers provided are in millions of

Q109: A bond is scheduled to mature in

Q110: U.S. Treasury quotes from the WSJ on

Q111: The numbers provided are in millions of

Q111: A bond is scheduled to mature in

Q113: The numbers provided are in millions of

Q114: The numbers provided are in millions of

Q115: The following is an FI's balance sheet

Q116: The numbers provided are in millions of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents