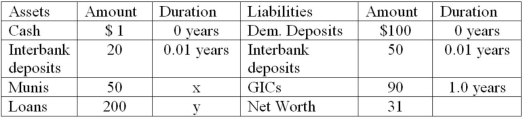

The following is an FI's balance sheet ($millions) .  Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What will be the impact, if any, on the market value of the bank's equity if all interest rates increase by 75 basis points?

A) The market value of equity will decrease by $15,750.

B) The market value of equity will increase by $15,750.

C) The market value of equity will decrease by $426,825.

D) The market value of equity will increase by $426,825.

E) There will be no impact on the market value of equity.

Correct Answer:

Verified

Q96: Third Duration Investments has the following assets

Q97: Third Duration Investments has the following assets

Q98: The numbers provided by Fourth Bank of

Q99: Consider a five-year, 8 percent annual coupon

Q100: First Duration Bank has the following assets

Q102: The numbers provided are in millions of

Q103: U.S. Treasury quotes from the WSJ on

Q104: A bond is scheduled to mature in

Q106: The numbers provided are in millions of

Q113: A bond is scheduled to mature in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents