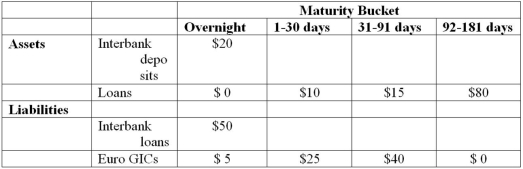

The following information details the current rate sensitivity report for Gotbucks Bank, Inc. ($million) .  What does Gotbucks Bank's 91-day gap positions reveal about the bank management's interest rate forecasts and the bank's interest rate risk exposure?

What does Gotbucks Bank's 91-day gap positions reveal about the bank management's interest rate forecasts and the bank's interest rate risk exposure?

A) The bank is exposed to interest rate decreases and positioned to gain when interest rates decline.

B) The bank is exposed to interest rate increases and positioned to gain when interest rates decline.

C) The bank is exposed to interest rate increases and positioned to gain when interest rates increase.

D) The bank is exposed to interest rate decreases and positioned to gain when interest rates increase.

E) Insufficient information.

Correct Answer:

Verified

Q67: The following are the assets and liabilities

Q68: Can an FI immunize itself against interest

Q68: The following information details the current rate

Q69: The balance sheet of XYZ Bank appears

Q70: The balance sheet of ARGH Insurance shows

Q73: The following are the assets and liabilities

Q74: The following are the assets and liabilities

Q75: The balance sheet of XYZ Bank appears

Q76: The following information details the current rate

Q77: The balance sheet of ARGH Insurance shows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents