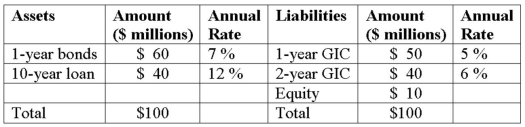

Hadbucks National Bank current balance sheet appears below. All assets and liabilities are currently priced at par and pay interest annually.  Can the FI immunize itself from interest rate risk exposure by setting the maturity gap equal to zero?

Can the FI immunize itself from interest rate risk exposure by setting the maturity gap equal to zero?

A) Yes, because with a maturity gap of zero the change in the market value of assets exactly offsets the change in the market value of liabilities.

B) No, because with a maturity gap of zero, the change in the market value of assets exactly offsets the change in the market value of liabilities.

C) No, because the maturity model does not consider the timing of cash flows.

D) Yes, because the timing of cash flows is not relevant to immunization against interest rate risk exposure.

E) No, because a representative bank will always have a positive maturity gap.

Correct Answer:

Verified

Q84: Hadbucks National Bank current balance sheet appears

Q85: The following is the balance sheet of

Q86: Duration Bank has the following assets and

Q87: Duration Bank has the following assets and

Q88: Hadbucks National Bank current balance sheet appears

Q90: Hadbucks National Bank current balance sheet appears

Q91: Hadbucks National Bank current balance sheet appears

Q92: Duration Bank has the following assets and

Q93: Hadbucks National Bank current balance sheet appears

Q94: Hadbucks National Bank current balance sheet appears

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents