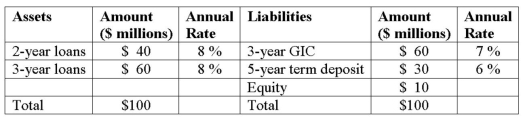

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually.  What is the effect on the value of the FI's equity if interest rates decrease by 1 percent?

What is the effect on the value of the FI's equity if interest rates decrease by 1 percent?

A) Gain of $0.697 million.

B) Gain of $0.338 million.

C) Loss of $1.622 million.

D) No change in equity.

E) Loss of $0.605 million.

Correct Answer:

Verified

Q100: Duration Bank has the following assets and

Q101: Which theory of term structure posits that

Q102: Which theory of term structure argues that

Q103: The liquidity premium theory of the term

Q104: Duration Bank has the following assets and

Q106: The yield curve

A)relates rates for different maturities

Q108: The market segmentation theory of the term

Q108: Which theory of term structure states that

Q109: The unbiased expectations theory of the term

Q110: The term structure of interest rates assumes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents