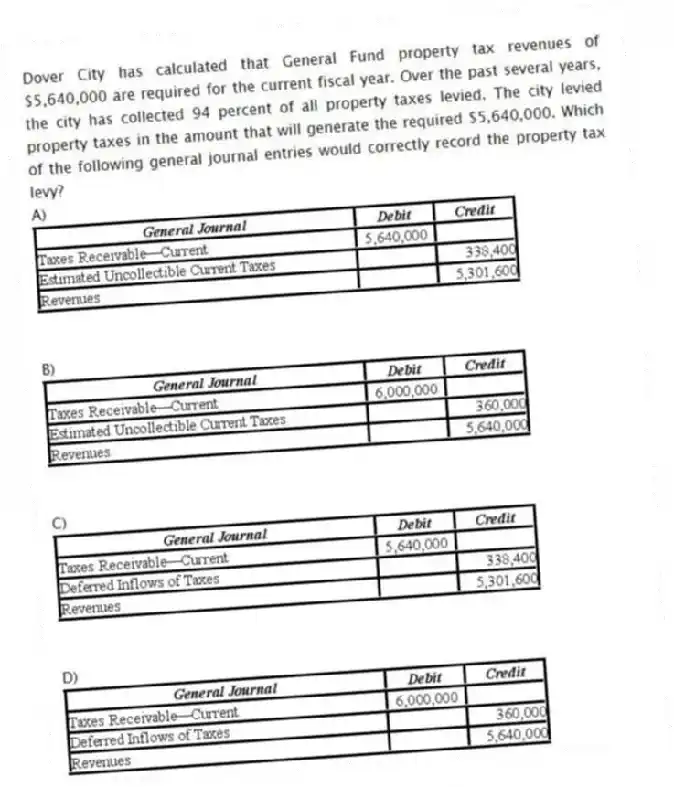

Dover City has calculated that General Fund property tax revenues of $5,640,000 are required for the current fiscal year. Over the past several years, the city has collected 94 percent of all property taxes levied. The city levied property taxes in the amount that will generate the required $5,640,000. Which of the following general journal entries would correctly record the property tax levy?

A)

B)

C)

D)

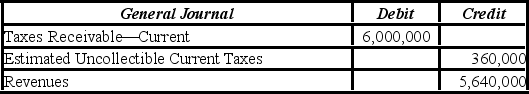

Correct Answer:

Verified

Q32: When equipment is ordered by a department

Q33: An interfund transfer occurs when one fund

Q34: The receipt of equipment that had previously

Q35: Which of the following financial statement(s) reports

Q36: An interfund transfer in should be reported

Q38: Fines and forfeits are reported as charges

Q39: The General Fund has transferred cash to

Q40: The City of Pringle purchased a

Q41: Using the information below, what amount should

Q42: Cartier Village's capital expenditures during the year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents