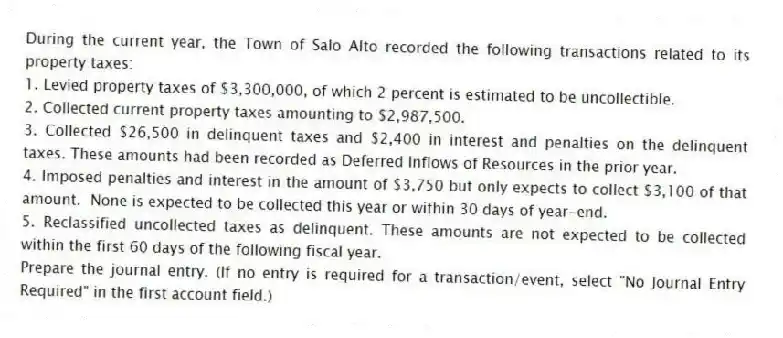

During the current year, the Town of Salo Alto recorded the following transactions related to its property taxes:

1. Levied property taxes of $3,300,000, of which 2 percent is estimated to be uncollectible.

2. Collected current property taxes amounting to $2,987,500.

3. Collected $26,500 in delinquent taxes and $2,400 in interest and penalties on the delinquent taxes. These amounts had been recorded as Deferred Inflows of Resources in the prior year.

4. Imposed penalties and interest in the amount of $3,750 but only expects to collect $3,100 of that amount. None is expected to be collected this year or within 30 days of year-end.

5. Reclassified uncollected taxes as delinquent. These amounts are not expected to be collected within the first 60 days of the following fiscal year.

Prepare the journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Under the modified accrual basis of accounting,

Q81: Beach City received a gift of corporate

Q82: Why might actual revenues and expenditures reported

Q83: The following is a pre-closing trial balance

Q84: Identify the four types of nonexchange transactions

Q86: Select the appropriate term from the list

Q87: All revenues of the City of Capri

Q88: Why might the property tax revenue in

Q89: The following transactions occurred for the City

Q90: During fiscal year 2020, the Town of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents