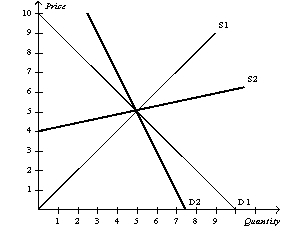

Figure 6-24

Suppose the government imposes a $2 on this market.

-Refer to Figure 6-24.Suppose D1 represents the demand curve for gasoline in both the short run and long run,S1 represents the supply curve for gasoline in the short run,and S2 represents the supply curve for gasoline in the long run.After the imposition of the $2,

A) buyers bear a higher burden of the tax in the short run than in the long run.

B) sellers bear a higher burden of the tax in the short run than in the long run.

C) buyers and sellers bear an equal burden of the tax in both the short run and long run.

D) buyers and sellers bear an equal burden of the tax in the short run, but buyers bear a higher burden of the tax in the long run.

Correct Answer:

Verified

Q16: Price controls are usually enacted when policymakers

Q194: Suppose the demand for macaroni is inelastic,the

Q195: Which of the following was not a

Q197: The burden of a luxury tax falls

A)more

Q388: Figure 6-24

Suppose the government imposes a $2