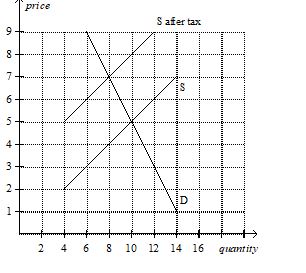

Using the graph shown, answer the following questions.

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

a.What was the equilibrium price in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

e.How much will the buyer pay for the product after the tax is imposed?

Correct Answer:

Verified

b.$3

c.$2

d.$1

e.$7

f.$4

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q146: Even though federal law mandates that workers

Q147: The true burden of a payroll tax

Q150: Most of the burden of a luxury

Q154: If the demand curve is very inelastic

Q155: A tax burden falls more heavily on

Q158: A tax on a market with elastic

Q159: The burden of a luxury tax most

Q160: Who bears the majority of a tax

Q211: Using a supply and demand diagram, show

Q551: Using the graph shown, answer the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents