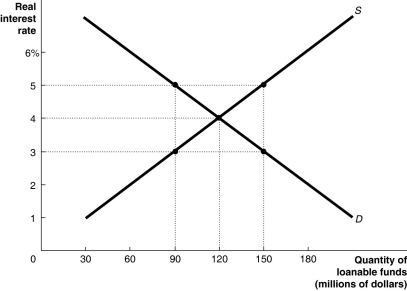

Figure 6.6  Alt text for Figure 6.6: In figure 6.6, a graph shows loanable funds market in equilibrium.

Alt text for Figure 6.6: In figure 6.6, a graph shows loanable funds market in equilibrium.

Long description for Figure 6.6: The x-axis is labelled, quantity of loanable funds (millions of dollars) , ranging from 0 to 180 in increments of 30.The y-axis is labelled real interest rate, ranging from 0 to 6% in increments of 1.2 intersecting lines are shown.A line labelled D begins at the top left corner and slopes down toward the end of the x-axis.Another line labelled S begins near the origin and slopes upward to the top right corner.5 points are plotted on these two lines as (90, 5) , (90, 3) , (120, 4) , (150, 5) , (150, 3) .These points are connected to their respective coordinates on the x-axis and y-axis using dotted lines.

-Refer to Figure 6.6.The market is in equilibrium.If the government budget deficit rises, which of the following would you expect to see?

A) The quantity of loanable funds demanded by firms will rise above $120 million.

B) The quantity of loanable funds demanded by firms will fall below $120 million.

C) The budget deficit will have no impact on the quantity of loanable funds demanded by firms.

D) The interest rate will fall below 4 percent.

E) The interest rate will rise about 10 percent.

Correct Answer:

Verified

Q161: Retained earnings are sufficient to finance a

Q164: Empirical evidence shows that the impact of

Q168: Carefully define the two categories of saving

Q171: In an open economy,the relationship between GDP

Q192: Which of the following would occur if

Q193: Which of the following will increase the

Q194: Explain and show graphically how a decrease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents