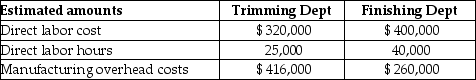

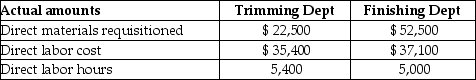

Solid Oak Bureau Company uses job costing. Solid Oak Bureau Company has two departments, Trimming and Finishing. Manufacturing overhead is allocated based on direct labor cost in the Trimming Department and direct labor hours in the Finishing Department. The following additional information is available:  Actual data for completed Job No. 650 is as follows:

Actual data for completed Job No. 650 is as follows: What is the predetermined manufacturing overhead rate for the Finishing Department?

What is the predetermined manufacturing overhead rate for the Finishing Department?

A) $6.50 per direct labor hour

B) $52.00 per direct labor hour

C) $10.00 per direct labor hour

D) $10.40 per direct labor hour

Correct Answer:

Verified

Q185: The underallocation or overallocation of overhead is

Q192: Alpha Technology's work in process inventory on

Q193: Wet N Wild Sports Equipment Company's work

Q194: If manufacturing overhead allocated is less than

Q195: Records for Speedy's Custom Networks contained the

Q196: Overallocated overhead costs occur when the overhead

Q198: Hardrock Company uses job costing. Hardrock Company

Q200: Solid Oak Bureau uses job costing. Solid

Q208: The amount of overallocation or underallocation should

Q238: Manufacturing overhead is overallocated if the amount

A)allocated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents