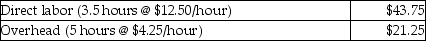

Dire Corporation uses the following standard costs for a single unit of product:  Actual data for the month showed overhead costs of $425,000 for 22,500 units produced. What is the difference between actual overhead costs and standard overhead costs allocated to products?

Actual data for the month showed overhead costs of $425,000 for 22,500 units produced. What is the difference between actual overhead costs and standard overhead costs allocated to products?

A) $329,375 favorable

B) $329,375 unfavorable

C) $53,125 favorable

D) $53,125 unfavorable

Correct Answer:

Verified

Q162: The Chilton Corporation specializes in manufacturing one

Q163: The variable overhead rate variance may be

Q165: Batchelder Manufacturing reported the following budgeted and

Q167: Fabian Fabrication machines heavy-duty brake rotors that

Q168: Fabian Fabrication machines heavy-duty brake rotors that

Q169: Fabian Fabrication machines heavy-duty brake rotors that

Q171: The total variable manufacturing overhead variance is

Q173: Speaker City designs and manufactures high-end home

Q174: The variable overhead rate variance tells managers

Q179: The variable overhead rate variance is also

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents