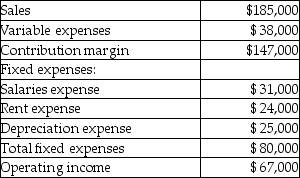

Buxton Corporation is evaluating a capital investment project which would require an initial investment of $240,000 to purchase new machinery. The annual revenues and expenses generated specifically by this project each year during the project's nine year life would be:  The residual value of the machinery at the end of the nine years would be $15,000. The payback period of this potential project in years would be closest to

The residual value of the machinery at the end of the nine years would be $15,000. The payback period of this potential project in years would be closest to

A) 2.6.

B) 3.6.

C) 3.1.

D) 1.4.

Correct Answer:

Verified

Q63: Sparky the Electrician specializes in rewiring historic

Q65: Pro-Am Audio is a company that is

Q68: The Hawn Corporation bought a new machine

Q70: GlenGary Investment Corporation is analyzing a proposal

Q72: When computing the present value of a

Q78: Bonneville Manufacturing is considering an investment that

Q80: Smith & Cramer,Computer Repair,is considering an investment

Q81: One dollar to be received in the

Q94: The Future Value of $1 table is

Q98: Calculating interest on the principal and on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents