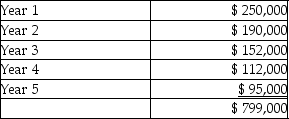

(Present value tables are needed.) Somerville Corporation is considering investing in specialized equipment costing $618,000. The equipment has a useful life of 5 years and a residual value of $55,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are:  Somerville Corporation's required rate of return is 14%.

Somerville Corporation's required rate of return is 14%.

The net present value of the investment is closest to

A) $62,976 negative.

B) $5,886 negative.

C) $34,431 negative.

D) $181,000 positive.

Correct Answer:

Verified

Q131: What will happen to the net present

Q137: (Present value tables are required.)Maersk Metal Stamping

Q141: Senseman Company has three potential projects from

Q143: (Present value tables are needed.)Cleveland Cove Enterprises

Q144: (Present value tables are needed.)The Janus Vending

Q145: (Present value tables are needed.)Cleveland Cove Enterprises

Q146: (Present value tables are needed.)Family Fun Park

Q147: (Present value tables are needed.)The Janus Vending

Q149: (Present value tables are required. )Currence Corporation

Q160: Which of the following is a weakness

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents