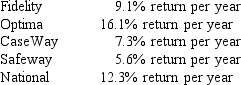

Bob and Dora Sweet wish to start investing $1,000 each month. The Sweets are looking at five investment plans and wish to maximize their expected return each month. Assume interest rates remain fixed and once their investment plan is selected they do not change their mind. The investment plans offered are:

Since Optima and National are riskier, the Sweets want a limit of 30% per month of their total investments placed in these two investments. Since Safeway and Fidelity are low risk, they want at least 40% of their investment total placed in these investments.

Formulate the LP model for this problem.

Correct Answer:

Verified

Q25: If there is no way to simultaneously

Q45: When the objective function can increase without

Q52: Solve the following LP problem graphically using

Q55: The Byte computer company produces two models

Q56: Solve the following LP problem graphically by

Q57: Solve the following LP problem graphically using

Q58: Solve the following LP problem graphically by

Q59: Solve the following LP problem graphically using

Q60: Jim's winery blends fine wines for local

Q62:

Joey Koons runs a small custom computer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents