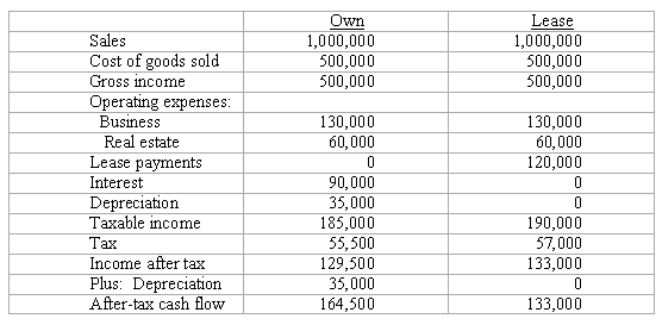

A company is planning to move to a larger office and is trying to decide if the new office should be owned or leased.Cash flows for owning versus leasing are estimated as follows.Assume that the cash flows from operations will remain level over a 10 year holding period.If purchased,the company will invest $385,000 in equity and finance the remainder with an interest-only loan that has a balloon payment due in year 10.The after-tax cash flow from sale of the property at the end of year 10 is expected to be $750,000.What is the incremental rate of return on equity to the company,if the property is owned instead of leased?

A) 17.99%

B) 13.26%

C) 10.32%

D) 12.62%

Correct Answer:

Verified

Q8: Which of the following tax law changes

Q10: Which of the following does NOT represent

Q11: Which of the following is true for

Q11: Non-recourse debt,such as a mortgage on a

Q12: When doing a sale versus lease analysis,how

Q13: The cash flows considered in a sale-leaseback

Q13: A company estimates that the incremental cost

Q16: An operating lease does not affect a

Q18: The cash flow to be considered in

Q18: In general,if a company assumes that the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents