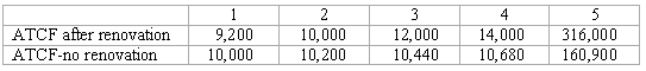

An investor is considering renovating a building.Total cost of renovations are expected to be $100,000 of which 75% can be borrowed.Given the after-tax cash flows to the equity investor as showed below,what is the incremental return from renovating?

A) 9.75%

B) 10.14%

C) 15.32%

D) 12.67%

Correct Answer:

Verified

Q1: An investor purchased a property expecting to

Q5: The marginal rate of return can be

Q9: Which of the following is NOT a

Q10: Given the same expectations for future rents

Q12: An investor calculates an incremental return of

Q18: The benefits of equity buildup in a

Q27: A property worth $16 million can be

Q33: An investor purchased a building in 1982

Q34: Disposition when dealing with real estate means

Q37: A property should be sold when which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents