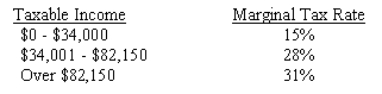

An investor who has $75,000 in taxable income purchases a building that produces another $15,000 in taxable income.According to the table below,what is the marginal tax rate?

A) 29.50%

B) 29.57%

C) 28.00%

D) 31.00%

Correct Answer:

Verified

Q1: A gross lease is riskier for the

Q1: Which of the following is FALSE,concerning DCR:

A)

Q4: Which of the following definitions of income

Q10: Which of the following is FALSE regarding

Q20: The debt coverage ratio is used by

Q21: A property is sold for $5,100,000 with

Q23: A property that produces a level of

Q32: A property produces a first year NOI

Q33: A property that produces a first year

Q36: A small office building is purchased of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents