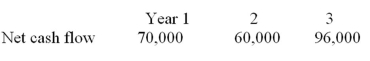

Slippery Slope Roof's net cash flows are as follows:  After year 3,net cash flows grew at a constant rate of 3%. The weighted average cost of capital is 9%. What is the value of the firm?

After year 3,net cash flows grew at a constant rate of 3%. The weighted average cost of capital is 9%. What is the value of the firm?

A) 1,215,650

B) 1,328,141

C) 1,461,439

D) 1,575,941

E) None of these.

Correct Answer:

Verified

Q38: All else equal,a more liquid stock will

Q39: For the levered firm the equity beta

Q40: Two stock market based costs of liquidity

Q41: Given the sample of returns of the

Q42: Suppose that the Hu's Corporation common stock

Q44: Explain the factors that determine beta and

Q45: The net cash flows of Advantage Leasing

Q46: The Neptune Company offers network communications systems

Q47: Daniel's Sound Systems has 210,000 shares of

Q48: Suppose the Barges Corporation's common stock has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents